Best Investing Opportunities for 2026

As markets evolve, 2026 is shaping up to be a pivotal year for investors focused on long-term growth and strategic…

By Dave Roberts on January 6, 2026

Scrap Gold Prices Soar after Senate Passes Big Beautiful Bill

Scrap gold prices are looking better and better as we head towards the “Big Beautiful Bill” becoming law. While I…

By Jeff Siegel on July 2, 2025

Rare Earth Stocks Plummet on China Trade Deal

Rare earth stocks took a hit this morning after China indicated it would approve new exports of rare earth minerals…

By Jeff Siegel on June 27, 2025

The Best Oil Stocks To Own This Week

The best oil stocks to own this week are all American oil stocks. Of course, it doesn’t take a rocket…

By Jeff Siegel on June 23, 2025

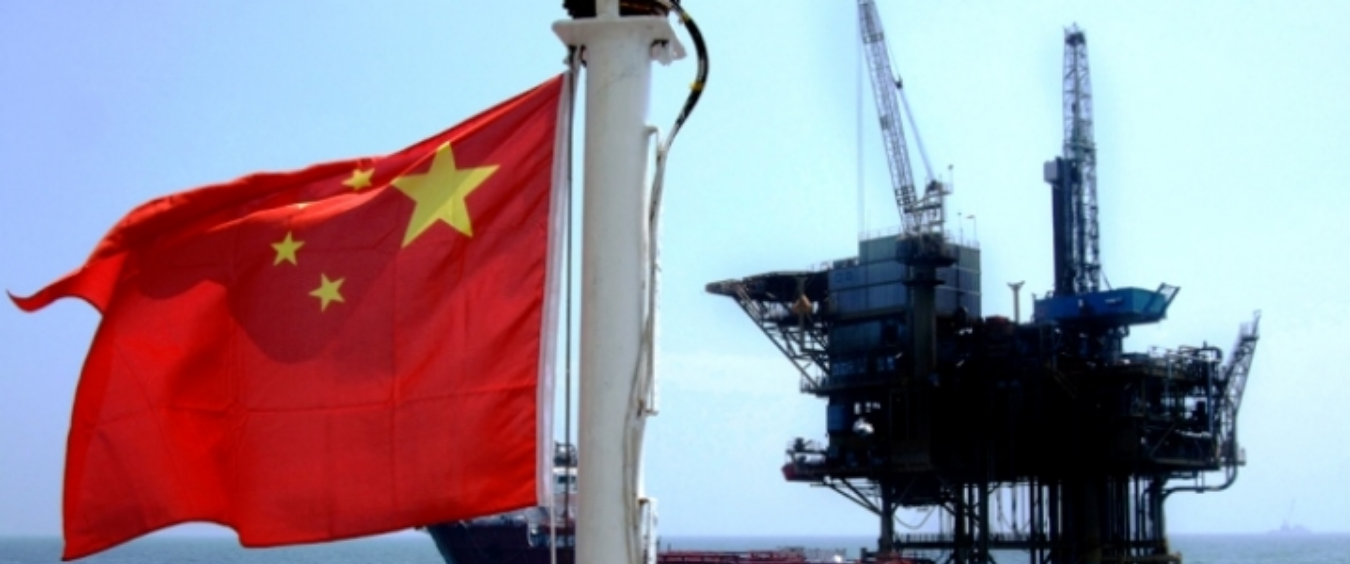

China Oil Demand Could Gut Oil Prices

China oil demand is set to peak two years ahead of schedule. This, according to the International Energy Agency’s (IEA)…

By Jeff Siegel on June 20, 2025