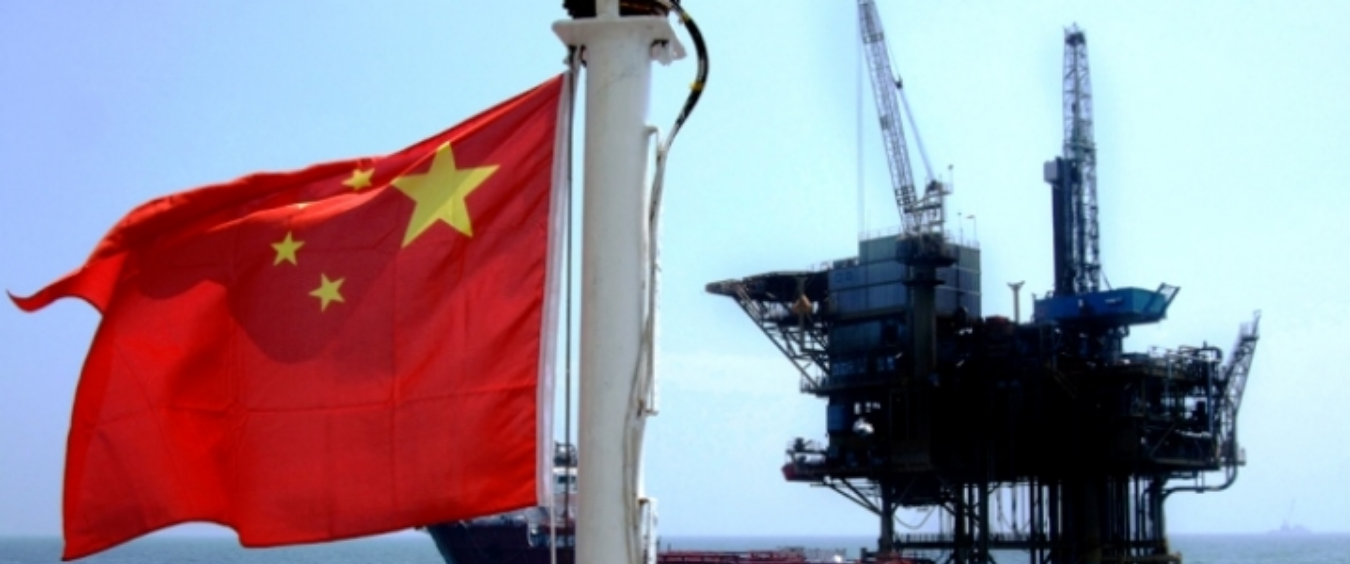

China Oil Demand Could Gut Oil Prices

China oil demand is set to peak two years ahead of schedule.

This, according to the International Energy Agency’s (IEA) latest analysis which indicates that China’s oil consumption will top out at 16.9 million barrels per day by 2027. This is actually a big deal as China is the world’s second largest consumer of oil.

One of the reasons for this massive decline in demand is the Middle Kingdom’s exploding demand for electric vehicles. Last year, EV sales in China topped out at around 11.5 million units. Just ten years prior, only 34,000 EVs were sold.

This represents a compound average growth rate (CAGR) of just over 79%. And while EV sales have slowed in recent years, EV sales numbers continue to climb as sales of conventional internal combustion vehicles decline. In fact, EV sales in China are expected to surpass sales of traditional gas-powered vehicles this year.

Of course, this doesn’t mean global oil demand will peter out before the end of the decade. Certainly India and other emerging markets around the world continue to see increases in oil demand. But that, too, will fade as EV adoption continues to expand across the globe. And this represents both a danger for the U.S. and a huge advantage for China.

Sinking China Oil Demand Poses a Threat for the U.S. Economy

Today, the U.S. is the largest producer of oil in the world.

Indeed, this has benefitted the U.S. economy and our national security in a major way. But if we are to believe that oil demand will continue to shrink – on a global scale – then we must recognize that this presents a very big problem for the U.S. economy.

Today, the U.S. oil and gas industry is responsible for almost 8% of our GDP. As well, it supports more than 10 million jobs. Yet according to the Energy Information Administration (EIA), U.S. oil output is expected to peak in just 2 years, plateau by the end of the decade, then rapidly fall from 2030 through 2050.

Of course, random natural disasters and war in the Middle East will always provide a boost for oil prices, but those situations will never be enough to affect the long-term decline in oil production and consumption. No matter how badly OPEC and President Trump attempt to convince the world otherwise.

So how do you play this?

Well, you can always attempt to short oil either directly or through an ETF, like the ProShares UltraShort Bloomberg Crude Oil ETF (NYSE: SCO). But this is best utilized as a trade to take advantage of big swings in oil prices.

Long-term, oil prices will continue to decline, but it’s not going to happen overnight, and because inverse ETFs can be risky, I don’t recommend SCO as a “set it and forget it” type play.

Truth is, your best bet would be to focus on the things that are going to benefit from a decline in internal combustion vehicles sales. This could be anything from EV makers, such as BYD (OTCBB: BYDDY), NIO (NYSE: NIO), and LI Auto (NASDAQ: LI), to the mining companies that will consistently benefit from the continued growth of the EV market. These include, but are not limited to …

- Lundin Mining: (TSX: LUN)

- Freeport-McMoRan (NYSE: FCX)

- Silvercorp Metals (NYSE: SVM)

While it may not be obvious to those who don’t study transportation markets, those of us who do know an undeniable truth. We are at the beginning of a major transition of our global transportation economy. And that transition will favor EV development and disadvantage internal combustion vehicle growth. It’s inevitable. So invest accordingly.

Jeff Siegel

Array