More bad news for coal stocks

More bad news for coal stocks is coming.

One of the world’s largest coal producers and consumers is having a bit of a supply and demand dilemma. And the markets are taking notice.

According to the China Coal Transportation and Distribution Association, coal production in China has been rising, but demand is falling rapidly. And this has pushed prices down below cost in some cases.

As reported in Bloomberg, the benchmark at the port of Qinhuangdao was last quoted at a four-year low of 630 yuan a ton after dropping 17% this year. As a result, mining profits have plunged, and they’re likely to fall further.

Chinese coal output climbed 8.1% to a record 1.2 billion tons in the first quarter. At the same time, thermal power generation, which mostly uses coal, fell 2.3%, challenged by the country’s rapid adoption of clean energy.

Solar in China has already reached price parity with coal. But the recent proliferation of utility-scale battery storage has made coal less attractive. To be sure, this was China’s plan all along. To provide policy and economic support for clean energy and energy storage in an effort to bring down costs below coal. That was achieved, and now the expansion of clean energy and energy storage is underway.

Coal Stocks will Suffer

In terms of installed capacity, renewables surpassed coal last year. This, with 18% of the country’s electricity coming from solar and wind.

But here’s the rub …

By 2050, solar and wind are expected to account for 38% of China’s energy mix. Couple that with hydro, which is expected to account for 20% of the Middle Kingdom’s electricity, and you’re looking at renewable energy owning nearly 60% of the energy market in China.

Meanwhile, we’re now seeing estimates indicating that coal will provide less than 30% of the country’s electricity by 2050.

While this transition away from coal isn’t happening overnight, it’s definitely happening a lot faster than some have predicted.

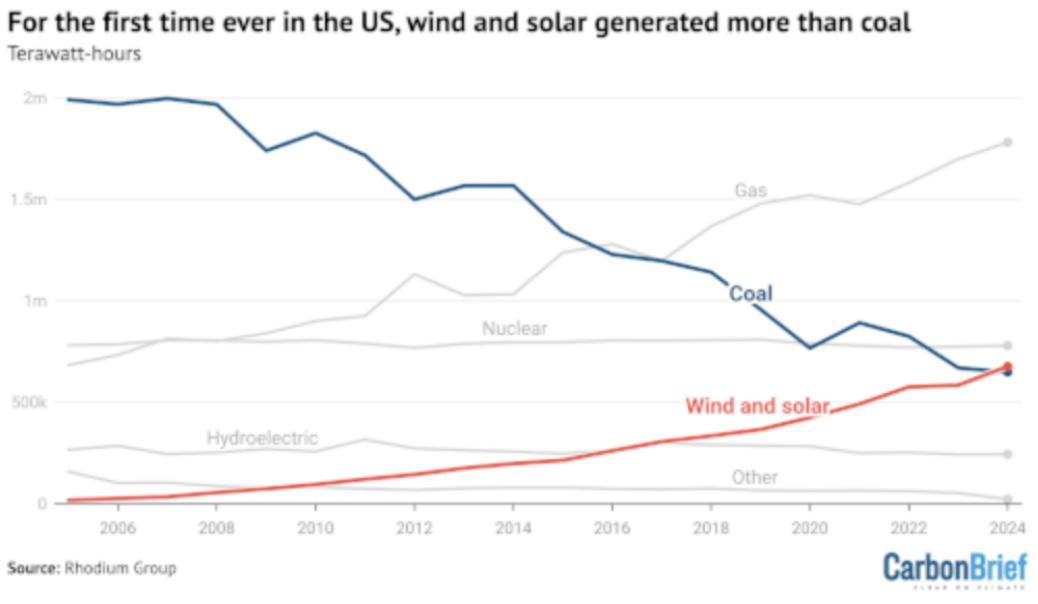

Coal will continue to lose market share in the U.S., too. In fact, in 2000, 51% of our energy mix came from coal. In 2024, it clocked in at around 16%. Worth noting: 2024 was also the first year that solar and wind generated more electricity than coal.

By 2040, coal will represent less than 10% of our energy mix.

While coal stocks are unlikely to struggle over the next year or two – particularly as a result of support from the White House – long-term, coal stocks are a sucker’s bet. Some of the coal stocks likely to be affected include …

- Core Natural Resources (NYSE: CNR)

- Alliance Resource Partners (NASDAQ: ARLP)

- Peabody Energy (NYSE: BTU)

- Hallador Energy (NASDAQ: HNRG)

Give it another year or two. But coal’s decline has already begun, and by around 2027, you’ll be hard-pressed to find a single coal stock delivering anything but losses.

Jeff

.

Array