Coinbase Stock Price Prediction 2025

My Coinbase stock price prediction 2025 has been updated. And for a very good reason.

Let me explain. …

Last year, once it was obvious that Donald Trump was going to win the election, I told investors to get bullish on crypto. This, because the incoming president made it very clear that he was eager to embrace Bitcoin and really just cryptocurrency in general.

He wanted the U.S. to take the lead on crypto mining and even create a strategic Bitcoin reserve. So when Trump did prove to be victorious over Kamala Harris, Bitcoin prices soared to record highs.

But it wasn’t just Bitcoin that benefited.

While the price of Bitcoin shot up more than 56% in the weeks following the election, shares of Coinbase (NASDAQ: COIN) shot up even higher.

Coinbase Stock Price Prediction 2025 Changes on Acquisition

If you’re unfamiliar, Coinbase provides a platform on which investors can buy and sell various crypto assets. It is the largest cryptocurrency exchange in the United States in terms of trading volume.

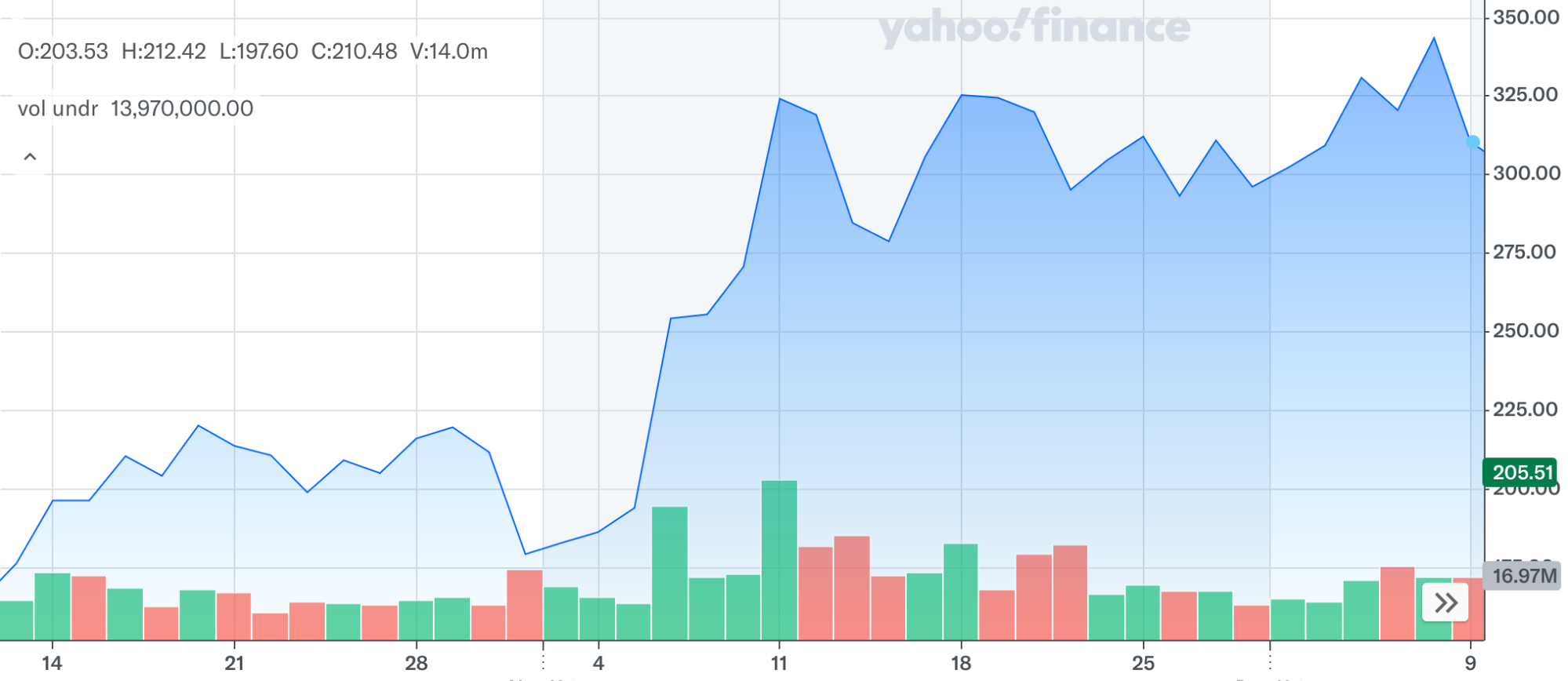

Here’s how Coinbase performed in the weeks following the election.

That’s a gain of more than 95% in just four weeks.

Of course, once the reality of Trump’s trade policies sunk in, Bitcoin sold off, and so did Coinbase. And until this trade war comes to an end, Bitcoin and Coinbase will be vulnerable. The good news is that at some point, the fires ignited by this trade war will be extinguished. And when that happens, you’re going to see the crypto sector take off again.

The higher-ups at Coinbase know that crypto is here to stay, so they recently strengthened the company’s position as the leading cryptocurrency exchange by ponying up $2.9 billion to acquire Deribit, which is the dominant player in the crypto options market. It actually processed $1.2 trillion in trade volume last year. That’s trillion – with a “T.”

While we’re all familiar with those who made small fortunes in Crypto, few people know those who’ve made massive fortunes with crypto derivatives. And with Coinbase now in control of the biggest crypto options player in the market, it’s now stronger than ever.

When Trump’s trade war began to take hold, I adjusted my expectations for Coinbase. I knew this trade war would gut any gains that were made earlier in the year. And I still believe that Coinbase’s stock price will be pressured by that. But with this latest deal, it would be foolish to suggest that the company’s latest access to $1.2 trillion in trade volume wouldn’t increase its valuation.

Today, Coinbase is trading around $206. With this new deal in place, Coinbase is worth at least $220 a share.

As a side note: if you’re looking for another way to play crypto derivatives, consider CME Group (NASDAQ: CME).

CME is a financial services company that operates financial derivatives exchanges. It’s actually the world’s largest operator of financial derivatives exchanges, facilitating trading in agriculture, energy, metals, futures contracts, stock indices, options, and yes, cryptocurrencies.

While CME is not a pure play on crypto derivatives, it does have that exposure with the added bonus of not being solely reliant on crypto. With that bit of added safety, CME is actually up 21.8% for the year while COIN is still down around 17% for the year. My one-year price target on CME is $290. CME also comes with a generous 3.7% dividend.

Array