Costco EV Charging Could Change the Game

Costco EV charging could change the game.

Or at least that’s the assumption.

You see, one of the perks of a Costco membership is cheap gas. In some cases, members can save up to $0.30 per gallon. That’s not trivial. Especially if you drive a gas guzzler. And while Costco has not yet reported its pricing plan for its EV chargers, it’s likely that the company will price its kilowatts a bit lower than you might find at a Tesla supercharger station.

Working with Electrify America, Costco will begin its EV charging offerings in Florida, Colorado, and California. If it proves to be successful, we expect the company to install these charging stations at most of its stores.

As an EV driver myself, I certainly welcome this move by Costco. Especially since I personally make a Costco run about once a month. This is also a solid move by Costco, as EV drivers tend to spend a lot of money at stores and restaurants that offer EV charging. I certainly do. In fact, EV charging options actually figure into my decision-making process when it comes to the places I choose to shop or eat.

I’m not sure those who drive gas-powered cars fully understand how much of a convenience this is. After all, it’s not like you can drive your Ford F-150 to a restaurant, go in and eat, then come back to your vehicle to see the fuel gauge sitting higher than where it was when you first arrived. It really is a lovely convenience. And it’s only going to get better.

You see, today, if I plug into a level-2 charger (this is not a fast-charger that can fully charge my battery in about 40 minutes), I can get about 30 miles of range per hour. But it won’t be long before I’ll be able to charge my car just as fast as it takes to fill an internal combustion vehicle with gas or diesel.

Costco EV Charging is just the Beginning

Last week, EV battery giant CATL unveiled its latest battery cell technology that can allow an EV to charge in about five minutes. This is a major breakthrough, and one that will ultimately get more folks into electric cars. After all, one of the biggest complaints about EVs is that it takes so long to re-charge them.

Of course, I usually plug my car in at night, so when I wake up in the morning, I have a “full tank.” But when I take road trips, I do have to use Tesla’s quick charging stations, which usually take about 40 minutes to get me back to a full charge. Just the thought of being able to take long road trips without having to stop for 40 minutes is welcomed news. Even though I probably only take 3 long road trips per year in my Tesla.

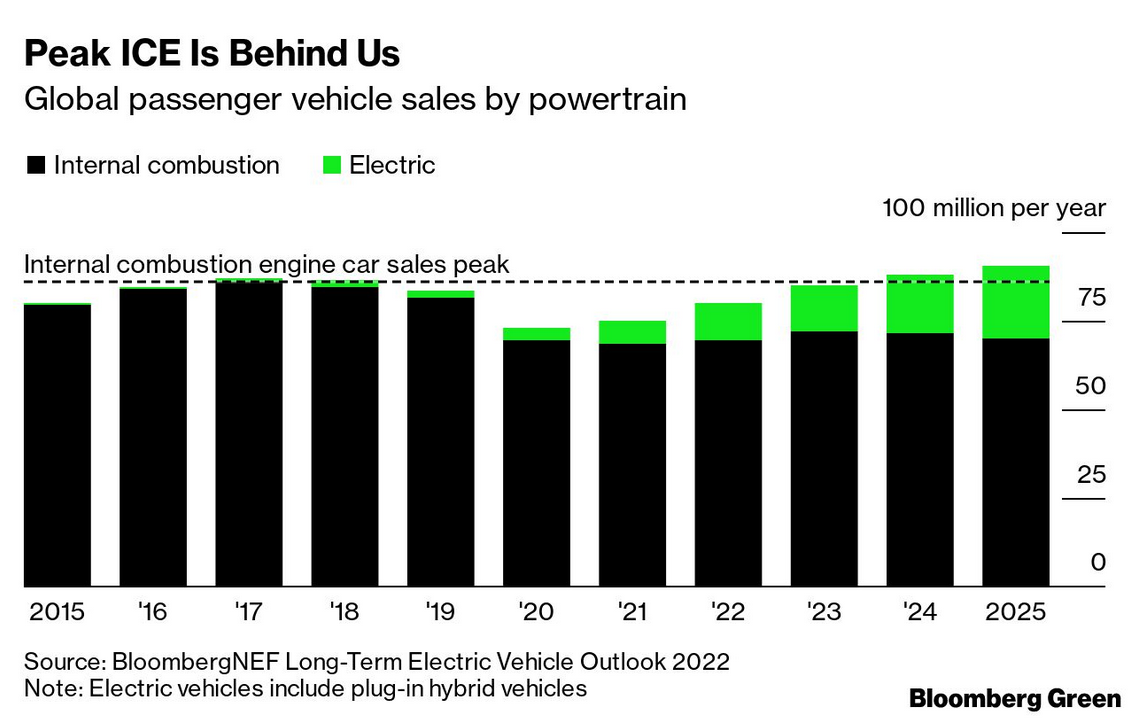

In any event, this isn’t just about my convenience. This is about a huge opportunity for investors. After all, even with recent slowdowns in car sales, EV sales growth continues to climb while sales of new internal combustion vehicles actually peaked back in 2017.

As demand for EVs continues to grow, so will the demand for fast charging options. And that’s exactly what CATL is bringing to the table.

Another benefit of CATL’s new battery is that it can recharge an EV from 5% to 80% in just 15 minutes in temperatures as low as 14 degrees Fahrenheit. As an EV owner, I can tell you that when it’s cold, it tends to take longer to charge my car. Which can be a bit of an inconvenience as colder conditions also reduce the overall range.

My Tesla, in perfect conditions, gives me about 310 miles per charge. Which is more than I use in any single day. In the U.S. this is one of the best options for “long-range” batteries. But CATL’s new battery delivers 497 miles of range on a single charge.

So here we have a battery that gives you nearly 500 miles on one charge, re-charge in about 5 minutes, and still operate at peak performance in below-freezing temperatures. Make no mistake: this is a game changer of epic proportions. And while CATL is already the largest producer of EV batteries in the world, its latest battery chemistry and technology will further solidify its dominance in the market.

Unfortunately, CATL does not trade on a U.S. exchange. At the moment, it only trades on the Shenzhen Stock Exchange (although it was recently approved for a listing on the Hong Kong exchange). Which means the only place most U.S. investors can buy shares of CATL today is through the brokerage platform, Interactive Brokers.

Not that this is a bad thing. Interactive Brokers is highly reputable, and plenty of folks in the U.S. do use it to purchase foreign stocks that don’t trade on the NYSE, Nasdaq, or bulletin boards.

You can also buy shares of a battery ETF that has CATL as one of its holdings. Some of these include …

- KraneShares Electric Vehicles and Future Mobility ETF (NYSE: KARS)

- KraneShares MSCI China Clean Technology Index ETF (NYSE: KGRN)

- Global X Lithium & Battery Tech UCITS ETF (NYSE: LIT)

- Amplify LIthium & Battery Technology (NYSE: BATT)

While it’ll likely take some time before we see these next-level batteries on U.S. roads (this is still a China-dominant EV play), the bar has just been set significantly higher. And any battery maker that can’t compete with CATL today, will definitely be unable to compete in the coming years.

Jeff

Array