We’ve all heard the trope “bigger is better.” It’s basically the Texas state motto, and for a lot of things, it’s true.

For example, when I was a kid, a good chunk of my time was spent getting teased and picked on by larger kids (i.e. my older brothers and cousins).

I always wanted to be bigger. I couldn’t wait to be big enough to tease them back — it’s all I thought about. So I was overjoyed when I reached my childhood growth spurts and shot up six inches in three years.

After a few years, I evened out at a respectable 5 feet 10 inches. Nothing to write home about, but no longer a prime candidate for wedgies.

Those growth spurts eventually stopped, and looking back, I’m happy they did.

If I continued to grow six inches every three years, I wouldn’t be able to fit through doorways. Forget getting revenge on my brothers, because I probably wouldn’t fit in my house right now.

Bigger can be better… until it’s too big. Eventually, that rate of growth not only stops being beneficial but actually stops being possible. In economics, we call that the law of large numbers.

Swiss mathematician Jacob Bernoulli developed this theorem in the 17th century, asserting that over a large sample of results, a variable will revert back to the mean.

Swiss mathematician Jacob Bernoulli developed this theorem in the 17th century, asserting that over a large sample of results, a variable will revert back to the mean.

For example, if you were to flip a coin enough times, the results will eventually even out at 50% heads, 50% tails.

In the financial world, we use the law of large numbers to refer to growth potential in terms of large companies.

How big is too big? At what point does that company’s historic growth rate become unsustainable?

Once a firm becomes too large, growing by even 20% each year becomes pretty difficult — more difficult than it is for a competitive start-up firm with a smaller market cap.

After a certain period of time, and after the company grows to be large enough, the rapid rise in share prices each year will eventually even out to the industry norm.

Not Just Computers Anymore

Apple Inc. (NASDAQ: AAPL) is the usual suspect here.

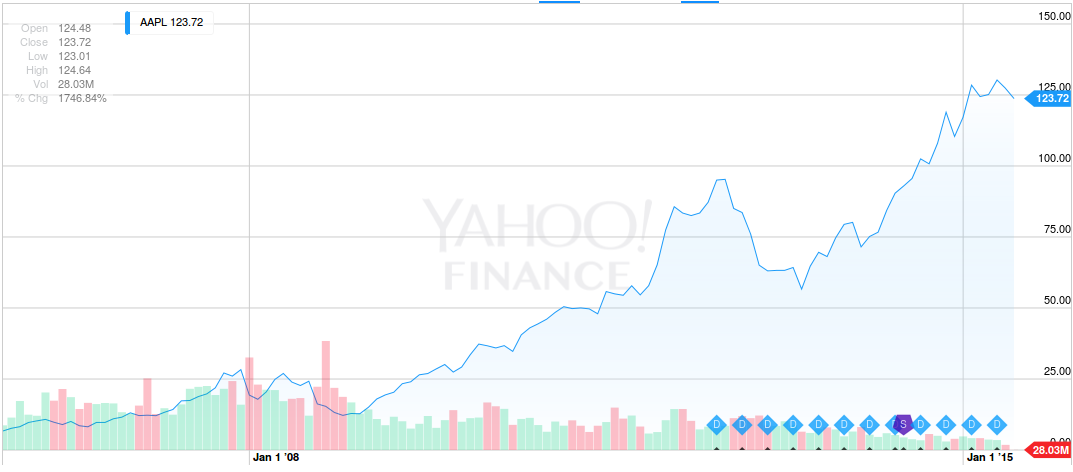

The company has boasted incredibly impressive growth rates over the past several years.

It’s the largest company ever… and I mean ever.

Just the last 10 years alone — which saw the bulk of the effects from the return of Steve Jobs — look like the life story of a fresh tech start-up… not the second act of an already multibillion-dollar globally recognized brand:

When people talk about Apple’s line of products and services, they refer to it as an “ecosystem.”

The company sells over 500 iPhones per minute.

Apple’s quarterly earnings are more than the subsequent eight companies combined. Its $750 billion market cap is equal to the combined market caps of the bottom 106 companies of the S&P 500.

In other words, the company’s market cap is 1/25th of the entire United States GDP.

Let’s say, hypothetically, Apple continues the 20% growth it’s experienced every year for the past decade.

If that remains the case, then next year Apple’s market cap will reach $900 billion.

The following year: $1.08 trillion…

$1.24 trillion…

$1.48 trillion…

And so on.

Apple will have to maintain $200 billion growth annually, but if it manages to do so, it will be worth over $2 trillion by 2022.

At that point, the company could afford to literally buy the earth at a rate of $10,000 per square mile.

It could afford to write a check for $18 to every person who has ever lived.

This all sounds great for Apple — except for the fact that it’s basically impossible. Unless the company develops a groundbreaking new product (maybe the iTimeMachine, iMindReader, iClone?), growth at those rates is not sustainable.

Unfortunately for Apple, most analysts expect the company’s growth to slow to 4% by next year.

Market Saturation: Beginning of the End

For one thing, Apple will simply run out of people to buy its devices.

The New York Times interviewed analyst Robert Cihra in 2012, who even a few years ago saw this coming. Cihra told NYT that to sustain the kind of growth Apple has experienced in the past decade, it “would have to sell an iPhone to every man, woman, child, animal, and rock on the planet.”

It sounds absurd, but it’s true.

No one is saying Apple is about to go bankrupt — that would be more extreme than selling an iPhone to a rock.

It might seem dramatic, but there will come a point when the market is completely saturated with Apple products and services, therefore closing the floodgates on the company’s current source of growth.

Apple’s success, now more than ever, is tied to the iPhone. The device accounts for 60% of the company’s revenues and 75% of profits. The iPhone is the only product line seeing expanding revenues, while all others are actually shrinking (especially the iPad).

It will be especially difficult for Apple to maintain its historic rate of growth with other tech companies biting at its heels. Android phone sales are starting to equal those of the iPhone. While Apple is focused solely on a line of increasingly similar devices, other companies are innovating and pushing boundaries into other technology sectors (in some ways creating entirely new tech industries).

We could be wrong. Someone could very well reference this article in the future as they write about Apple’s $5 trillion market cap. Apple could launch a fully functional autonomous car next month and experience a repeat of its late-1990s renaissance.

But I don’t think so.

Even without that renaissance, you could buy Apple stock today and still see a return. The company’s growth will undoubtedly continue in the future. The return won’t be remarkable, but it will still be a return.

Seventeen years ago, Anton Marinovich bought 400 shares of Apple for a total of $1,000. Now, his stock value teeters on the upside of $250,000.

Back in the 1980s, Apple shares were $2.75.

Now? $126.

If you, like Marinovich, got in on Apple stocks near the ground floor, you probably have the foresight and investment savvy to cancel your subscription today and go it on your own.

For the rest of us, it’s more helpful to use the history of Apple as a guide for our future investments.

For the most part, the company is stagnant. It’s in a stable place, but it’s hit a plateau. It’s unlikely that we’ll see another growth explosion.

Now, Apple is the status quo just waiting to be disrupted.

But 35 years ago, Apple was the disruptor — the new kid on the block.

Instead of thinking about investing in Apple today, we should be looking for companies that personify what Apple was 35 years ago, when its IPO instantly created 300 millionaires.

Which begs the question: How do we find these companies before they cement their market dominance?

Well, here are a couple that may just have what it takes.

– John Peterson