Dear Reader,

For most stocks that a typical investor tracks on a daily basis, trading volume doesn’t play a huge role in affecting their share prices.

For large mainstream companies like Apple (NASDAQ: AAPL) and IBM (NYSE: IBM), trading volume, despite share prices north of $100, averages in the millions.

On a major news day, like when a company announces the departure of a CEO or a new product release date, it’s not unusual to see that figure tick up to twice its normal price, with share prices dipping or spiking for the duration of that trading session.

But even with billions of dollars worth of additional stock changing hands, it’s still rare to see anything greater than a change of several percentage points in share price.

In the world of penny stocks, all that changes radically.

For many companies that fall into this category, trading volume takes on a whole different nature for the simple reason that regular trading, on a day-to-day basis, is anything but regular.

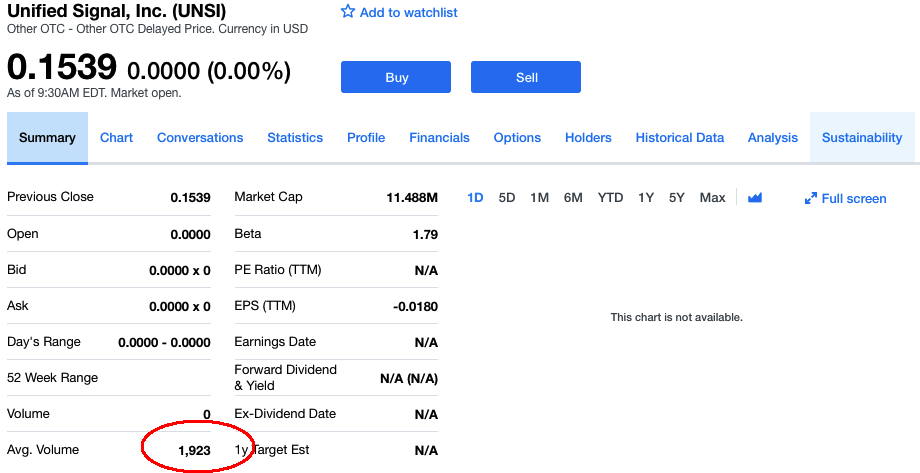

Many of the companies that I’ve watched over the years see daily trading volume averages in the single-thousands range:

That’s a pretty shocking figure, even before you consider that all this volume could be, and often is, generated by a single trader and sometimes by only a single trade.

But here’s where it gets interesting…

Average trading volume can’t remain stable at these levels unless the company is essentially dormant when it comes to the release of news.

So, when news comes out and trading volume increases by a factor of 10, 20, or even 100, it can do some pretty incredible things to share pricing.

Below, you’ll see a chart that tracks the price of the same stock that I cited earlier — after a single active trading session took hold:

You’ll see that even in the absence of later trading activity, share prices still increased by more than 50% over the next few weeks. And it stayed there.

And even this sort of price fluctuation is relatively mild in the event of a sudden volume spike.

Doubling over a week’s worth of trading or even within a single trading session is far from unheard of with penny stocks.

For us, the investors, that’s certainly a mouthwatering proposition. And it’s one of the reasons why news flow is so important to the viability of a microcap investment.

But these share price explosions come with evil dark sides.

Taking a step back from the numbers for a moment, let’s imagine what a volume spike actually is… It’s a new group of investors entering the fray with their own hopes and expectations, based on a favorable piece of news.

They chase the stock into new pricing territory with the belief that, in the future, somebody else will want to buy it back from them at an even higher price.

So, what happens when that favorable piece of news is followed by something less favorable like no news at all?

All those hopes and dreams turn into paranoia, disappointment, and eventually, the nagging urge to cut and run.

These cases of extreme buyer’s remorse are unfortunately common with microcap investors. And it’s because a lot of those investors are novices who were persuaded into the trade by less-than-reputable authorities, otherwise known as stock promoters.

When reality hits, and it usually does, all that manic volume will transform into panic selling. And the share price will collapse just as fast and, often further, than it ascended in the initial spike.

So, who profits in these scenarios?

Well, usually it’s those who owned the stock before the spike. And it’s no coincidence that it’s also these people who generally arrange the stock promotion — or are at least aware of it.

But does this mean that stocks with thin trading volume are always to be avoided? Not at all…

In fact, stocks with volume like the kind I showed earlier are in the exact stage where you should buy. And it’s because the spike hasn’t taken effect yet.

But if you’re eyeing a stock that just experienced the spike, I would pay close attention to its pre-spike average volume.

If there is none and if the news that sent buyers into a mania is a one-off event, or if there’s no event to speak of at all, then you’re probably looking at a temporary, unstable, and completely unsustainable share price trajectory.

Avoid those situations like the plague.

That’s all for now.

Until next time,

John Peterson

Pro Trader Today